Halcyon

AI Financial Advisory Intelligence

Platform Design for Revenue Growth

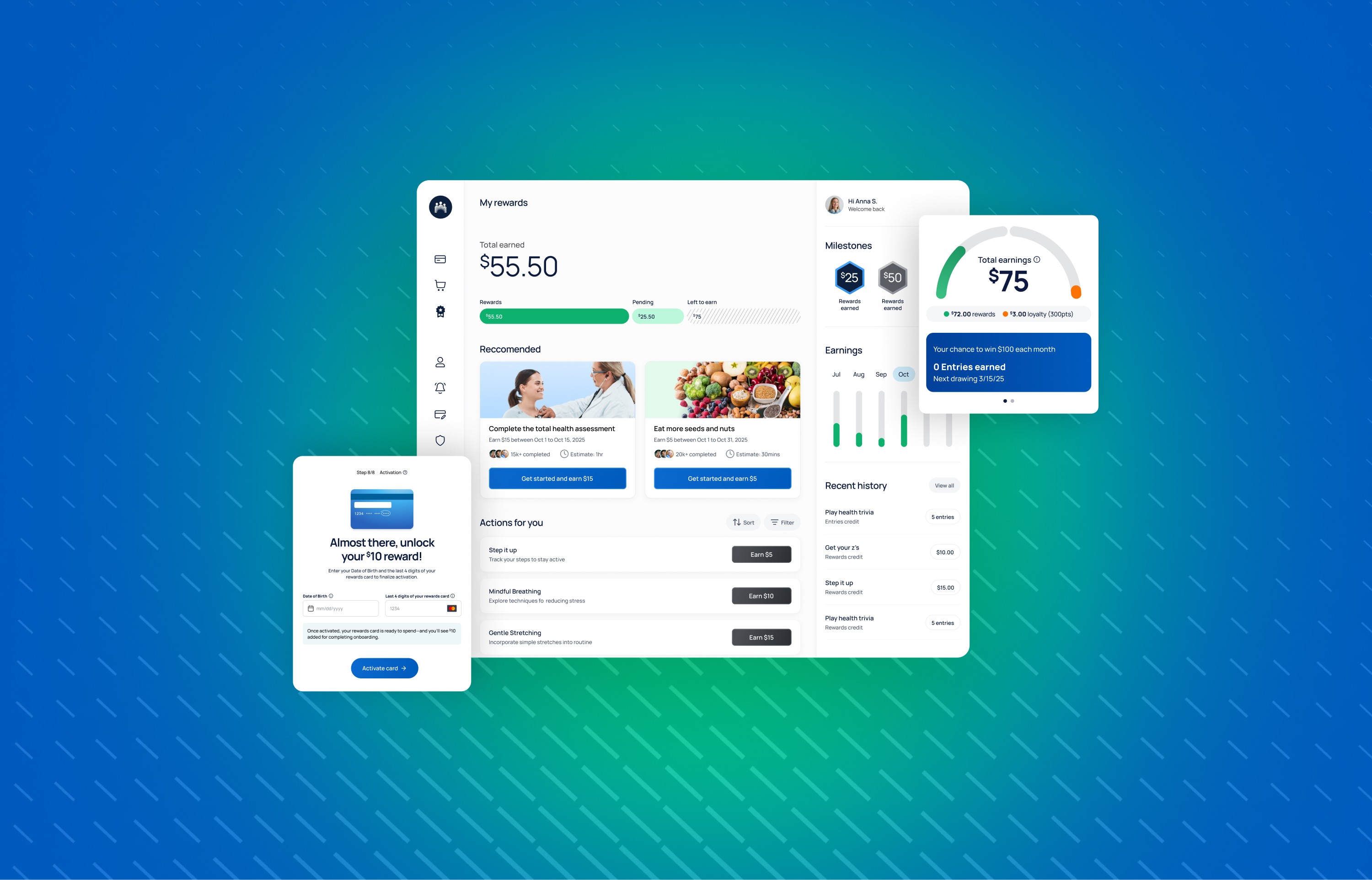

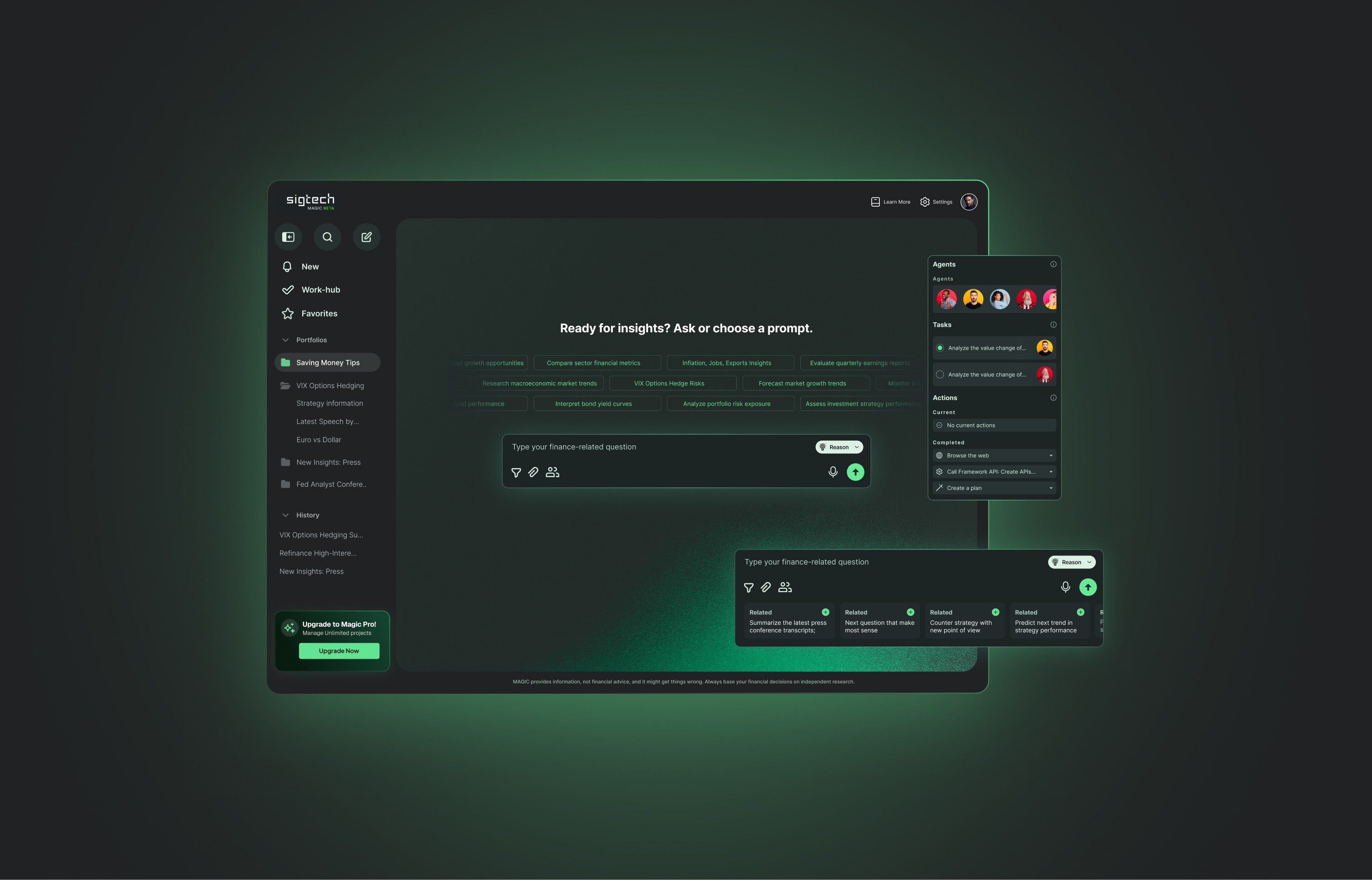

Halcyon is a predictive advisory intelligence platform that helps financial firms turn real-time portfolio data into actionable revenue opportunities.

I led UX for the core dashboard and insights workflow. We used qualitative research to simplify complex financial data, clarify signal detection, and redesign the advisor experience around confidence, speed, and execution.

key

responsibilities

UX Strategy / UX Audit / Research / UX Design / UI Design / Usability Testing / Design System / Accessibility Standards / Team Management

Project Overview

Halcyon is a predictive financial advisory intelligence platform used by wealth management firms to surface real-time risk and revenue opportunities. The strategic UX/UI overhaul streamlined the advisor experience across signal detection, prioritization, and action workflows, while scaling a unified design system and governance standards to support explainable analytics, faster delivery, and firm-wide adoption.

Challenge

Solution

The solution was a user-centered redesign of Halcyon’s core dashboard and insights engine, grounded in real advisor workflows and firm requirements. We simplified complex portfolio data into clear, prioritized signals, mapped the journey from detection to advisor action, and built a scalable design system to ensure consistency across teams and client environments. This gave Halcyon a sharper product narrative, a more confident experience for advisors and managers, and a stronger foundation for scaling predictive analytics, revenue attribution, and firm-wide adoption.

UX Strategy Roadmap

This UX strategy roadmap shows how I kept Halcyon moving from insight to shipped outcomes without losing alignment. It begins with research, combining UX audits, stakeholder interviews, and workflow analysis to define the real problems behind opaque signals, slow prioritization, and fragmented advisor tools. From there, the work moves into UX design, where I map the insight hierarchy, information architecture, and advisor journeys from detection to action. These flows are translated into wireframes and usability validation to ensure signal clarity, prioritization logic, and revenue attribution are sound before investing in visual polish.

Once the structure is solid, I guide UI design through prototypes, visual systems, and a scalable design system that standardizes dashboards, signal states, and interaction patterns across teams. Implementation emphasizes clean handoff, governance, and explainability standards so predictive insights remain transparent and audit-ready. Post-launch, we close the loop with adoption data and revenue impact signals, feeding learnings back into the next cycle to continuously improve clarity, trust, and time to action.

The design philosophy centers on transparent, explainable intelligence that empowers advisors to act with confidence and control.

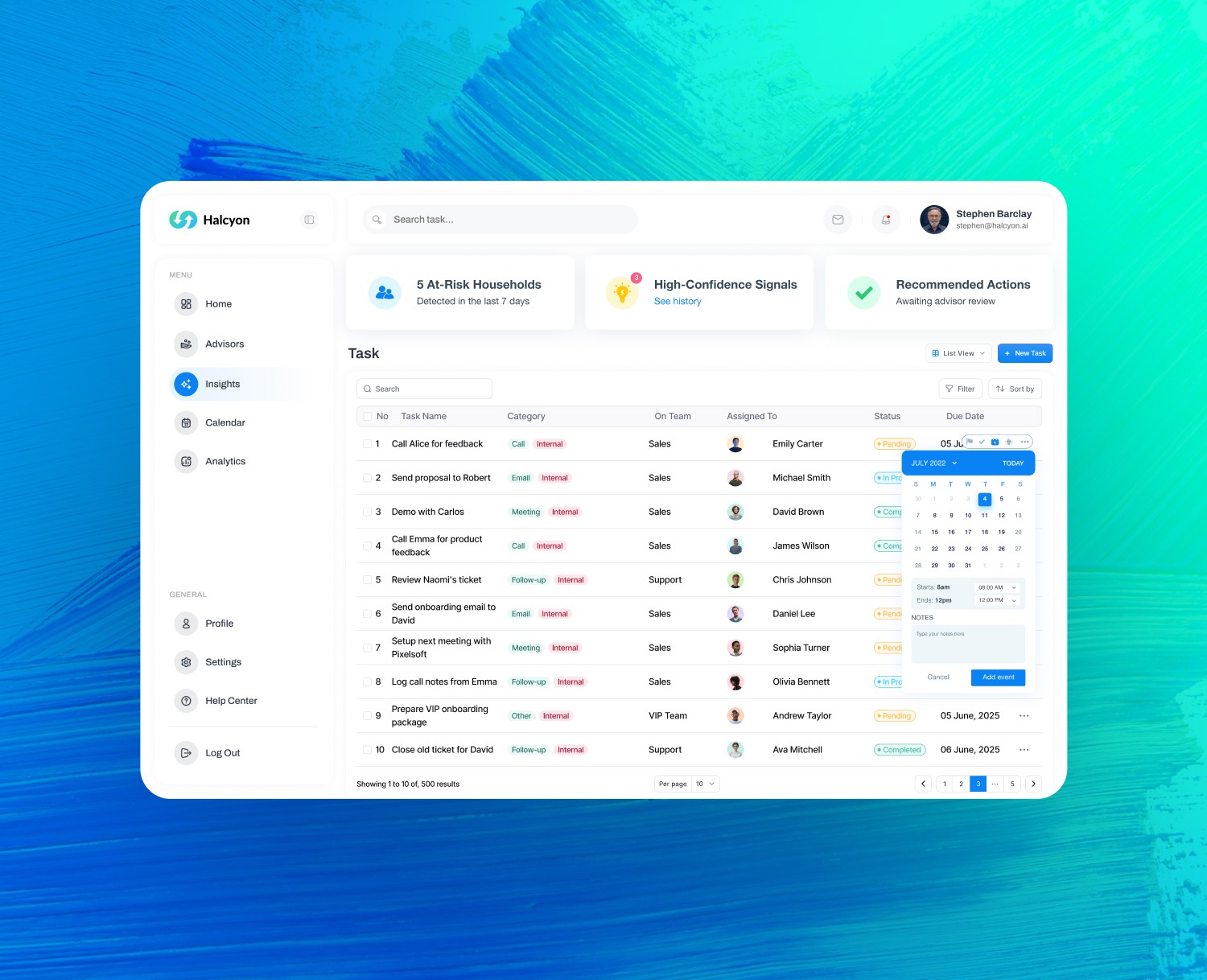

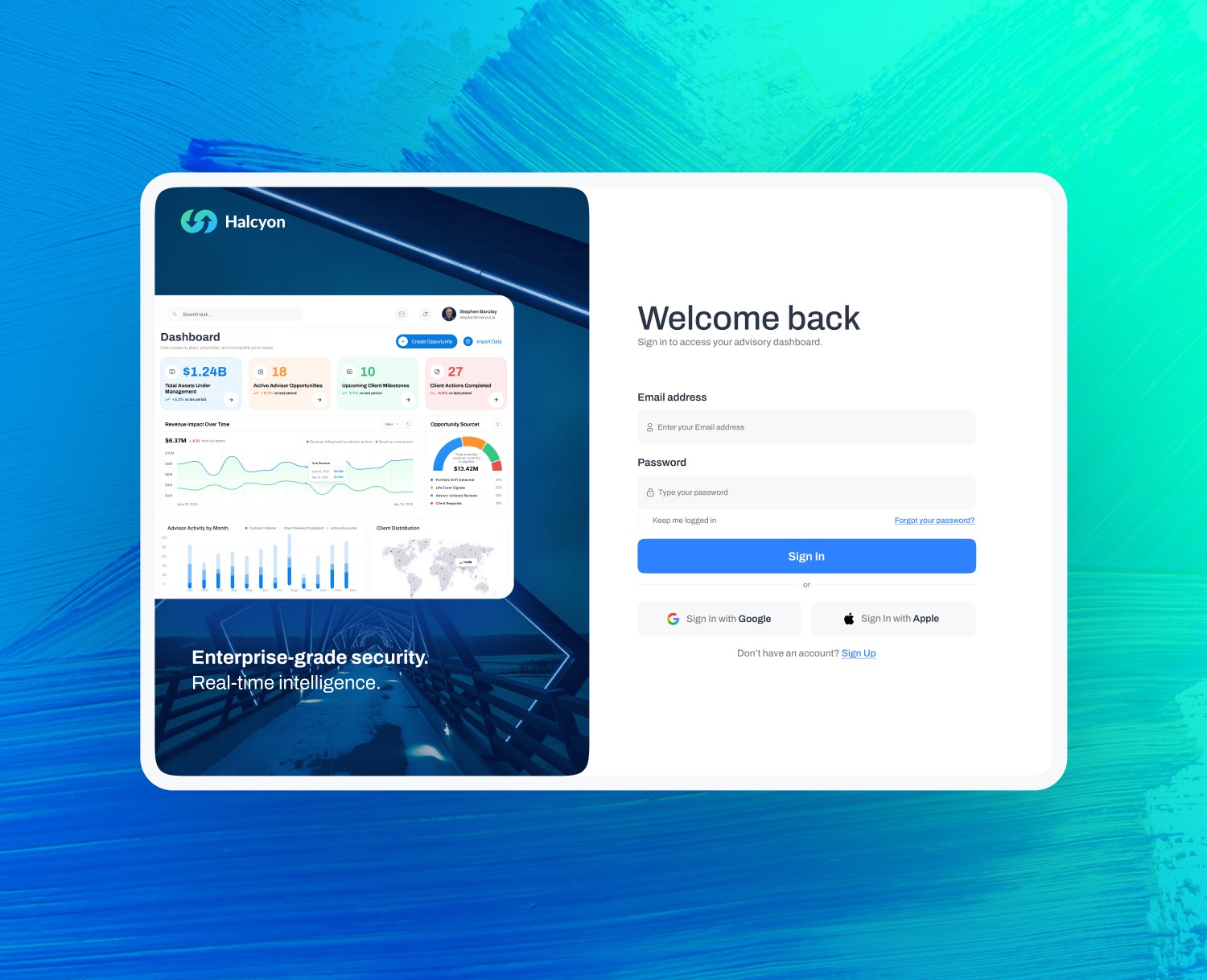

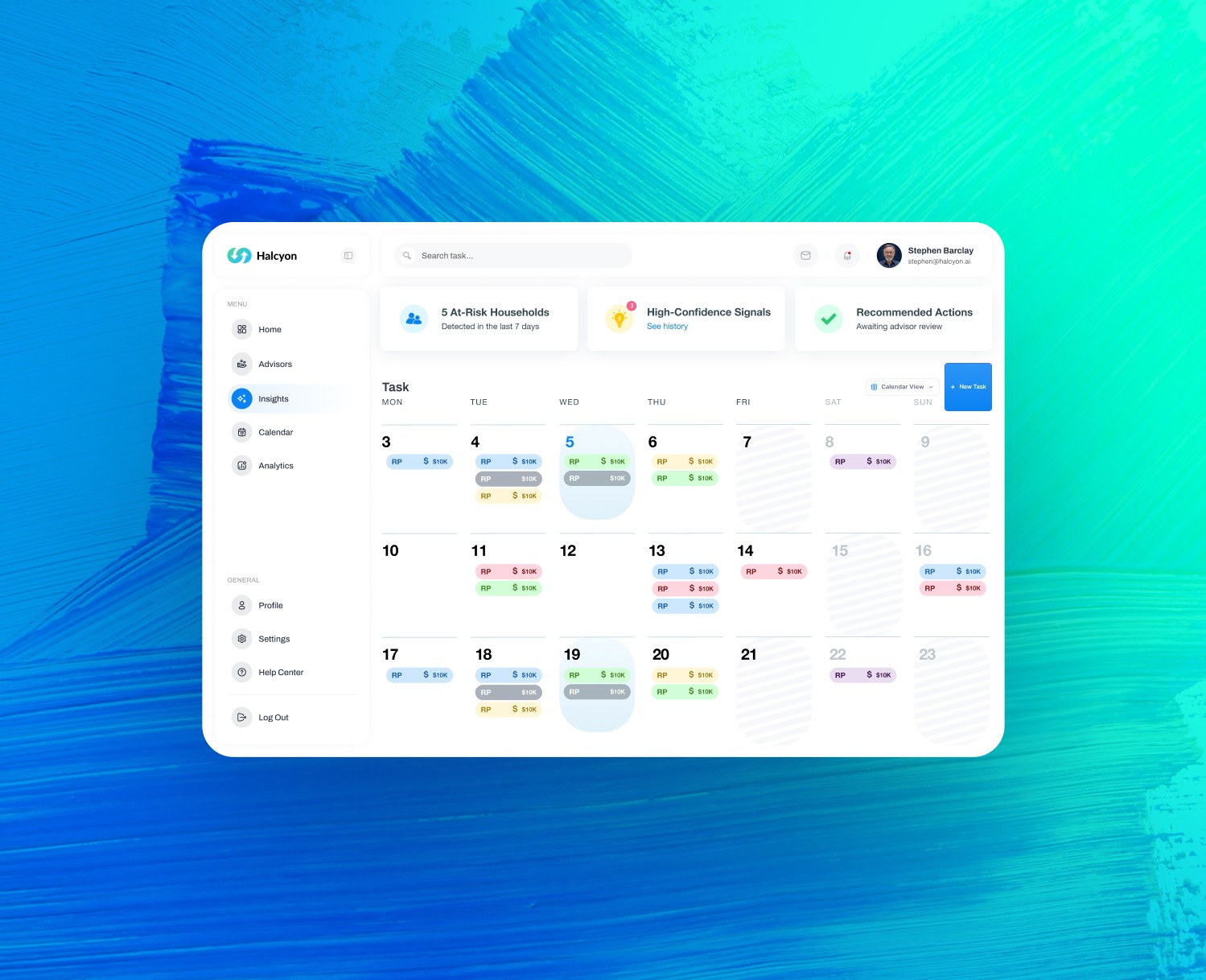

Final Design

The finalized Halcyon interface brings the design system to life, translating structure, transparency, and control into a cohesive advisory experience that guides users from signal detection to confident client action.

By redesigning the platform around explainable scoring, consistent data patterns, and governance-first standards, we reduced ambiguity and increased advisor trust at the moment of decision, strengthening both firm adoption and Halcyon’s ability to scale predictive intelligence responsibly.

Platform Impact Metrics

Real-world results from Halcyon, showing measurable gains in signal adoption, advisor confidence, and revenue-focused execution.

Signal adoption rate

Insight to action speed

Revenue influenced

Manual reporting effort

Testimonial

These testimonials from advisors and firm leaders provide third-party validation that Halcyon drives measurable impact. They reinforce trust in the platform and confirm the value of clearer signals, faster action, and stronger governance across advisory teams.

“Now I can see which clients need attention and why. I’m not guessing anymore.”

⸺ ADVISOR

“The opportunity scoring makes sense. When a signal appears, I understand the impact and what to do next.”

⸺ ADVISOR

“Now I can see which clients need attention and why. I’m not guessing anymore.”

⸺ OPERATIONS LEAD

“The opportunity scoring makes sense. When a signal appears, I understand the impact and what to do next.”

⸺ FIRM MANAGER

“Predictive insights feel controlled and explainable. That made it easier for us to support scaling the platform.”

⸺ COMPLIANCE LEAD

“Signal transparency changed everything. When advisors understand the ‘why,’ adoption follows and revenue conversations happen faster.”

⸺ HEAD OF ADVISORY STRATEGY